Mergers and acquisitions (M&A) is a broad term that refers to the consolidation of businesses or assets through a variety of financial transactions such as mergers, acquisitions, consolidations, tender offers, asset purchases, and management acquisitions (1). M&A has long been a preferred strategy for multinational corporations and other foreign competitors seeking to enter the Asian market, and the education sector will be no exception. Over the last few years, Singapore’s small Private Education Sector has seen its fair share of M&A activities.

M&A Analysis of education business in the Past Two Years

From the beginning of 2019 to the end of 2020, Berkery Noyes(2), an independent USA investment bank focused on mergers and acquisitions advisory, debt and equity financing, and valuation services, tracked 911 mergers and acquisitions (M&A) transactions in the education industry globally. It is worth noting that this applies to all segments, including traditional brick-and-mortar businesses. Deals involving a technological component accounted for nearly half of the total volume. Professional Training Services, with 110 transactions, surpassed K-12 Media and Technology as the industry’s most active market segment in 2020.

M&A activity increased by 6% in the second half of 2020 compared to the first half, from 209 to 222. Meanwhile, total transaction value increased by 67% in 2020, from $12.35 billion in 2019 to $20.63 billion in 2020. Some highlights include K12 Inc.’s $165 million acquisition of Galvanize, a Denver-based company that offers coding boot camp programs and Chegg’s $96 million acquisition of Mathway, a math problem-solving app. Among the notable K-12 transactions from the period was China Maple Leaf Education System’s $487 million purchase of Singapore’s Canadian International School (3).

Singapore PEIs are valuable to serious investors – the education business is evergreen

In Singapore, Eduvalue, in partnership with BAY Alliance (both members of the EV Education Group), have handled multiple M&A transactions ranging from a few hundred thousand dollars for smaller PEIs to multimillion-dollar transactions. Despite the challenging landscape of Singapore’s Private Education Institutes, investors in the education sector seeking to acquire potential PEIs see value in acquiring Singapore PEIs, according to the Eduvalue M&A Research Team. These investors see great potential in the education industry, and Singapore PEIs as very appealing options, especially for those looking to use Singapore as a platform and Hub to develop their businesses in this region.

It is worth noting that the main reasons driving investors in acquiring Singapore’s PEIs are attributed to:

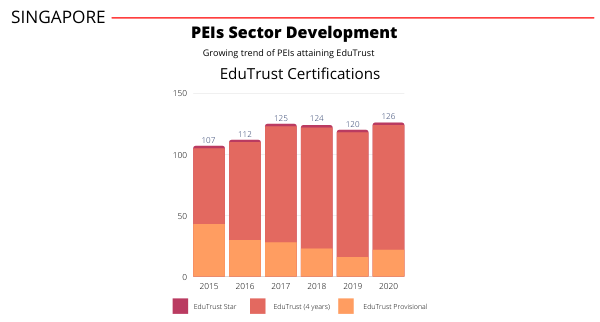

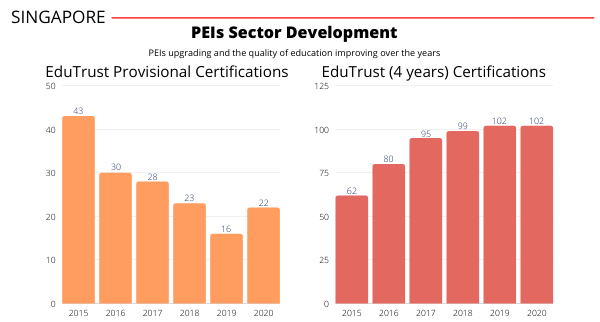

• The reputation of Singapore’s education systems and the strict regulatory quality assurance environment give good value propositions.

• The high barrier of entry for new entrants due to the difficulty of obtaining an education license and EduTrust certification in Singapore.

• Singapore’s proximity to regional education markets in Southeast and Northeast Asia, as well as emerging and developing economies.

• Rising demand in emerging economies due to urbanization and the rise of middle-income families, as well as the desire for better education and job opportunities.

• The always ongoing professional development, teacher development, adaptive learning and EdTech technological advances.

• A requirement for improved language training solutions (particularly English), Singapore as a multicultural and inclusive society that is conducive for study.

• Increased corporate spending on outsourced training programs is being driven by a strong need for corporate workforce training.

• Internet users who only use their smartphones to access the internet are reshaping learning models.

• Pre-primary enrolment is increasing as parents see the benefits of positive long-term educational outcomes.

• A result of changes in jobs and skills, as well as increased demand for new knowledge and skills, higher education is being forced to adapt in Singapore.

M&A as an exit strategy for struggling PEIs – the timing is right now!

For several years, PEIs have seen a sustained decline in student numbers. The challenging Covid-19 landscape does not make it easier for PEIs to operate, even more so when means and resources to go regionally or internationally are limited. PEIs are challenged to compete for Singapore students’ enrolments because the government institutions in Singapore absorb a large number of Singaporeans.

PEIs that lack the ability or capability to invest further in quality assurance, innovation, or product differentiation will struggle to survive. In recent years, the branded and larger foreign players who are well-funded have joined the Singapore PEI markets. As these players have strong financial backing and international capabilities to attract students, they have pushed many local PEIs out of the market over the years. Many educational institutions have the financial resources to invest in EdTech to enhance their attractiveness and value propositions to prospective students.

PEIs that still have a valid license like the ERF or EduTrust-certification, but are struggling to sustain the business could consider selling the business as an exit strategy or explore ways to partner stronger brands or educational funds in developing the Business.

Do speak to the EduValue M&A Team for any confidential discussion with regards to any exit strategies. We’ll love to share and assist.

References

1 Investopedia (2021). What Are Mergers and Acquisitions (M&A)? available

https://www.investopedia.com/terms/m/mergersandacquisitions.asp

2 Berkery Noyes (2021).An Overview of M&A in the Education Industry, available

https://berkerynoyes.com/an-overview-of-ma-in-the-education-industry-2/

3 PIE NEWS(2020).Singapore: Maple Leaf to take over CIS, available

https://thepienews.com/news/singapore-maple-leaf-take-over-canadian-intl-school/

Written By Alan Go, Eduvalue Researcher